Good afternoon, BM readers 👋

It’s been a while—long enough that I’m half-relying on muscle memory to piece this together. So, let’s dive in and make this return worthwhile.

It’s Wednesday, March 5, and here’s your succinct yet insightful weekly briefing.

“It's much better to do good in a way that no one knows anything about it.”

Leo Tolstoy

🏁 Quick Quips

🇮🇩 State-Owned Oil Giant or Corruption Hotbed? Pertamina’s Graft Troubles Deepen (Reuters)

Indonesia’s Attorney General’s Office (AGO) has arrested three Pertamina executives for alleged corruption in oil imports, adding to the state-owned energy giant’s long history of graft scandals. Between 2018 and 2023, the officials—Riva Siahaan, Yoki Firnandi, and Sani Dinar Saifuddin—allegedly bypassed regulations requiring domestic crude purchases, instead justifying costly imports, causing an estimated $11.85 billion in state losses. Prosecutors revealed that Indonesian crude met specifications but was exported while Pertamina’s subsidiaries bought foreign oil at inflated prices. Raids on properties linked to oil trader Mohammad Riza Chalid hint at wider collusion. This case highlights systemic governance failures at Pertamina, which has faced repeated corruption scandals, from fraudulent LNG procurement to oil trading and land acquisition schemes. With state-owned enterprises critical to Indonesia’s economy, the persistence of large-scale corruption raises concerns over regulatory enforcement, undermining investment confidence and energy security. Given Pertamina’s strategic role in Indonesia’s energy sector, persistent financial mismanagement and weak oversight not only drain public funds but also erode investor confidence and undermine the country’s long-term energy security.

📲 Honor’s $10 Billion AI Bet: Aiming Beyond Smartphones in IPO Push (TechRadar)

Honor, the Chinese smartphone maker and former Huawei subsidiary, has unveiled an ambitious $10 billion investment over five years to develop AI-driven devices as it moves towards a public listing. At the Mobile World Congress in Barcelona, CEO James Li outlined the "Honor Alpha Plan," a three-phase strategy to transition from a smartphone company to an AI-powered ecosystem, integrating AI across PCs, tablets, and wearables. This comes amid intensifying competition in China’s smartphone market, where Honor's market share fell to 14.9% in 2023, ranking fourth behind Huawei and Vivo. Honor’s AI push aligns with broader Chinese tech investment, particularly following the rise of DeepSeek’s low-cost AI models. With significant support from the Shenzhen government, including R&D funding and tax incentives, Honor is positioning itself as a global AI leader, collaborating with partners like Google Cloud and Qualcomm. However, with no clear IPO timeline and an increasingly competitive AI landscape, Honor’s long-term success will depend on the execution of its vision and the industry’s response to its open-ecosystem approach.

🍵 Matcha’s Supply Crunch: Soaring Demand and Japan’s Struggles to Keep Up (japantimes)

Japan is facing a matcha shortage, driven by surging global demand and supply constraints. In 2024, the country’s green tea export value, including matcha, reached a record ¥36.4 billion ($244 million), a 25% year-on-year increase, according to Japan’s Ministry of Agriculture, Forestry and Fisheries. Social media and tourism have played a key role in fuelling demand. In 2023, Japan welcomed 37 million visitors, up 47% from the previous year, with matcha-themed content proliferating across platforms like TikTok. This has put pressure on producers such as Kyoto-based Marukyu Koyamaen and Ippodo Tea, both of which have imposed purchase limits or temporarily suspended sales of certain matcha products. Compounding the issue is Japan’s declining tea production, which in 2023 was only 78% of 2008 levels, largely due to an ageing workforce and a shortage of successors. While established matcha businesses with long-term supplier contracts have maintained inventory, newer ventures are struggling to secure stock. The trend is not limited to Japan—tea businesses abroad, such as Australia’s Simply Native, have reported a fivefold increase in matcha sales over the past year. As demand continues to grow, price hikes and further supply constraints appear likely, highlighting the delicate balance between traditional agricultural production and modern consumption trends.

⛄ Mixue’s Record-Breaking IPO Signals Consumer Stock Surge in Hong Kong (SCMP)

Mixue’s IPO in Hong Kong has made waves, attracting a record HK$1.8 trillion (US$231 billion) in retail investor subscriptions, signalling both market optimism and investor confidence in consumer stocks. As China’s largest bubble tea chain, Mixue’s debut saw its stock surge 38%, highlighting the growing appeal of mass-market consumer brands. The company’s rapid expansion, with over 45,000 franchisees, is driven by a competitive supply chain that allows it to offer products at affordable prices, giving it an edge in the saturated bubble tea market. Despite its success, the company operates in a highly competitive sector, with other players like Sichuan Baicha Baidao struggling post-IPO. While Mixue’s valuation has been bolstered by its IPO, its future growth will depend on sustaining its market dominance amid intensifying competition and the need for constant innovation. Despite these challenges, Mixue’s IPO marks a significant milestone in Hong Kong’s recovery as a global IPO hub, with expectations of further growth in 2025.

P.S. Did someone forward you this email? Subscribe here for free

Global news and Market moves

📢 Meta in talks for $200bn AI data center project.

🚢 BlackRock Group to buy majority stake in Panama Canal ports for $22.8bn

⌛ Microsoft to retire Skype app from May 5, shifts focus to Teams.

📈 Nvidia bounces back from stock slide, climbing above $3tn market cap.

⚙️ TSMC announces $100bn additional investment to build US facilities.

🇺🇸🇺🇦 US suspends all military aid to Ukraine in wake of Trump-Zelenskyy row.

🚙 Vingroup signs deal with Qatar fund to seek potential $1bn investment in EVs.

🏷 Trump triggers trade war with tariffs on Canada, China and Mexico.

🛢️ OPEC+ boosts crude output, sending oil prices plummeting.

🇰🇷 South Korea’s first alternative stock exchange, NextTrade goes live.

💳 Citigroup mistakenly credits $81tn to customer account.

🇪🇺 European defense stocks surge following explosive White House meeting.

🤖 Amazon unveils Ocelot, its first quantum computing chip.

🇰🇵 FBI accuses North Korea in $1.5bn Bybit crypto theft, the biggest in history.

🇮🇷 Iran’s finance minister impeached as inflation rises, currency falls.

🧬 mRNA vaccines show promise in pancreatic cancer in early trial.

🇨🇳 China’s Liu Jiakun wins the 2025 Pritzker Architecture Prize.

🇸🇬 Singapore’s property giant CDL stock plunges to 16-year low amid family feud.

🚀 Blue Origin announce members for first all-female crew ahead of mission.

📉 PE firms scramble to cut losses from failed renewable energy bets.

💸 FTX’s bankruptcy nears $1B in costs, one of most expensive in history.

📊 The Week in Numbers

Golden Visa Trends Amid Political Uncertainty 🌍

💰 Golden Visas have become a strategic tool for high-net-worth individuals (HNWIs) seeking greater mobility, financial security, and lifestyle benefits. However, evolving regulations, rising investment thresholds, and concerns over real estate inflation are reshaping the landscape.

🔒 Political Uncertainty Drives Demand

Golden Visas have long been a favoured tool for wealth preservation, but recent political turmoil has intensified their appeal:

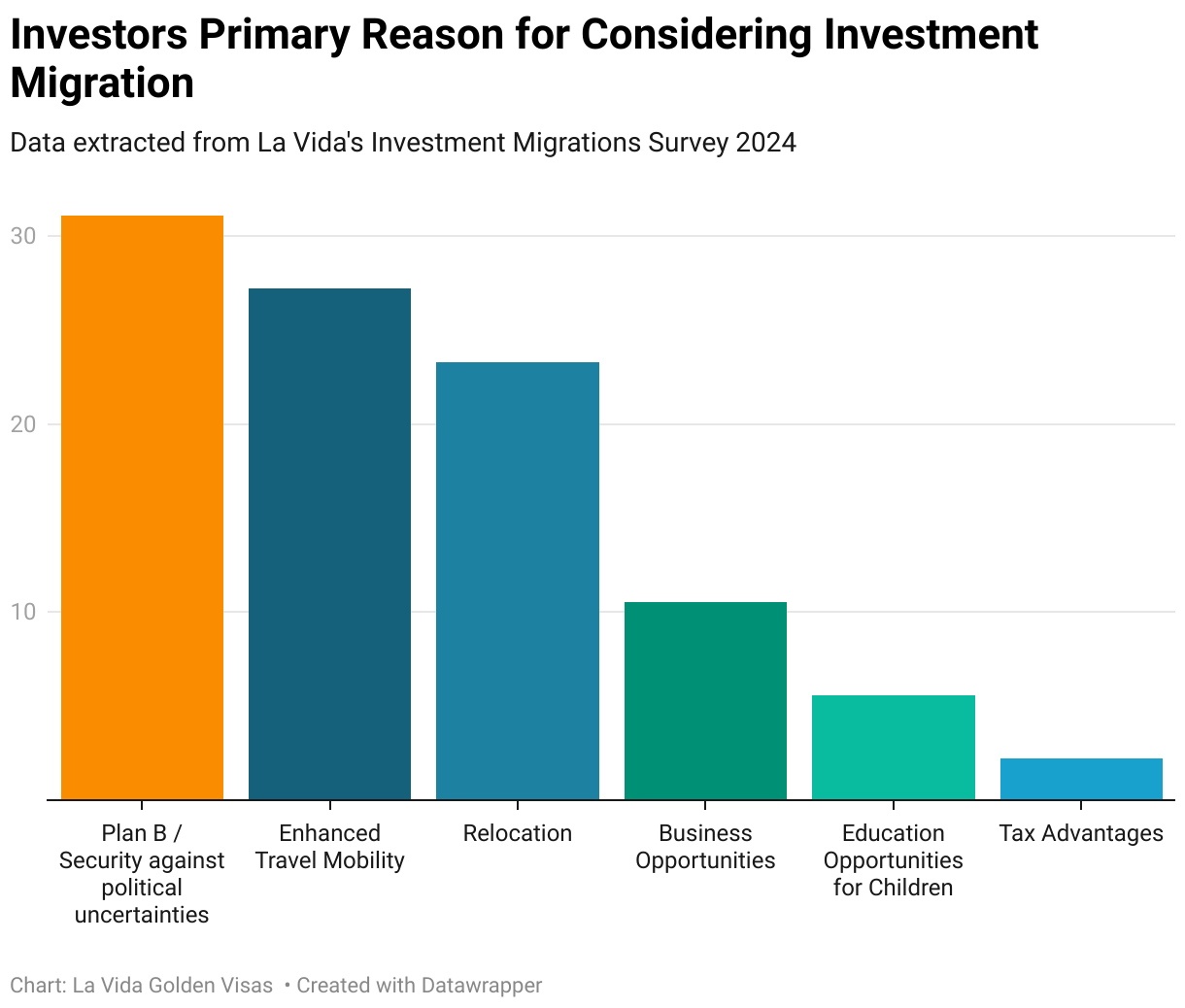

31.11% of investors cite political instability as their primary reason for seeking a Golden Visa.

23.3% want relocation opportunities, reflecting a growing preference for geographic flexibility.

15.6% are motivated by wealth management strategies, leveraging residency for tax optimisation.

Why it matters: With rising geopolitical tensions, shifting tax policies, and economic uncertainty, many HNWIs are securing second residencies as a safety net.

📈 Golden Visa Market Trends: Where Are Investors Going?

As demand surges, the top five most popular Golden Visa destinations in 2024 are:

1️⃣ Portugal 🇵🇹 – Strong infrastructure, EU access, and tax incentives.

2️⃣ Greece 🇬🇷 – Affordable property investment thresholds (€250K).

3️⃣ Spain 🇪🇸 – Attractive for British and Latin American investors.

4️⃣ Malta 🇲🇹 – Popular for ultra-high-net-worth individuals (UHNWIs).

5️⃣ UAE 🇦🇪 – Zero income tax and business-friendly regulations.

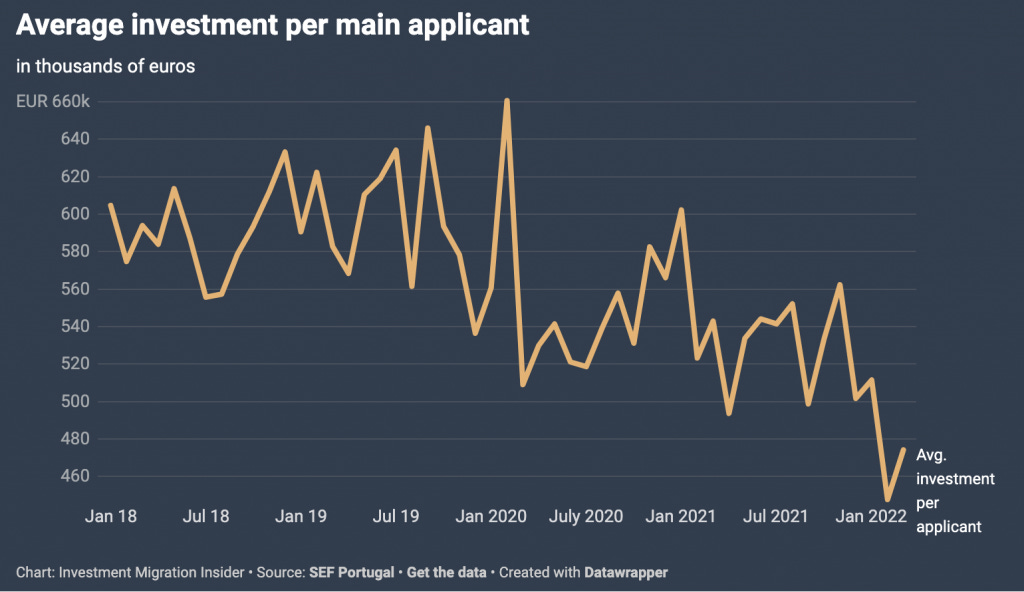

Portugal and Greece have seen a 25% increase in applications in the past year.

Malta’s Golden Visa remains one of the most sought-after, despite recent EU scrutiny.

UAE's 10-year Golden Visa saw a 40% rise in demand from global investors in 2023.

💰 Investment Breakdown: What’s Required?

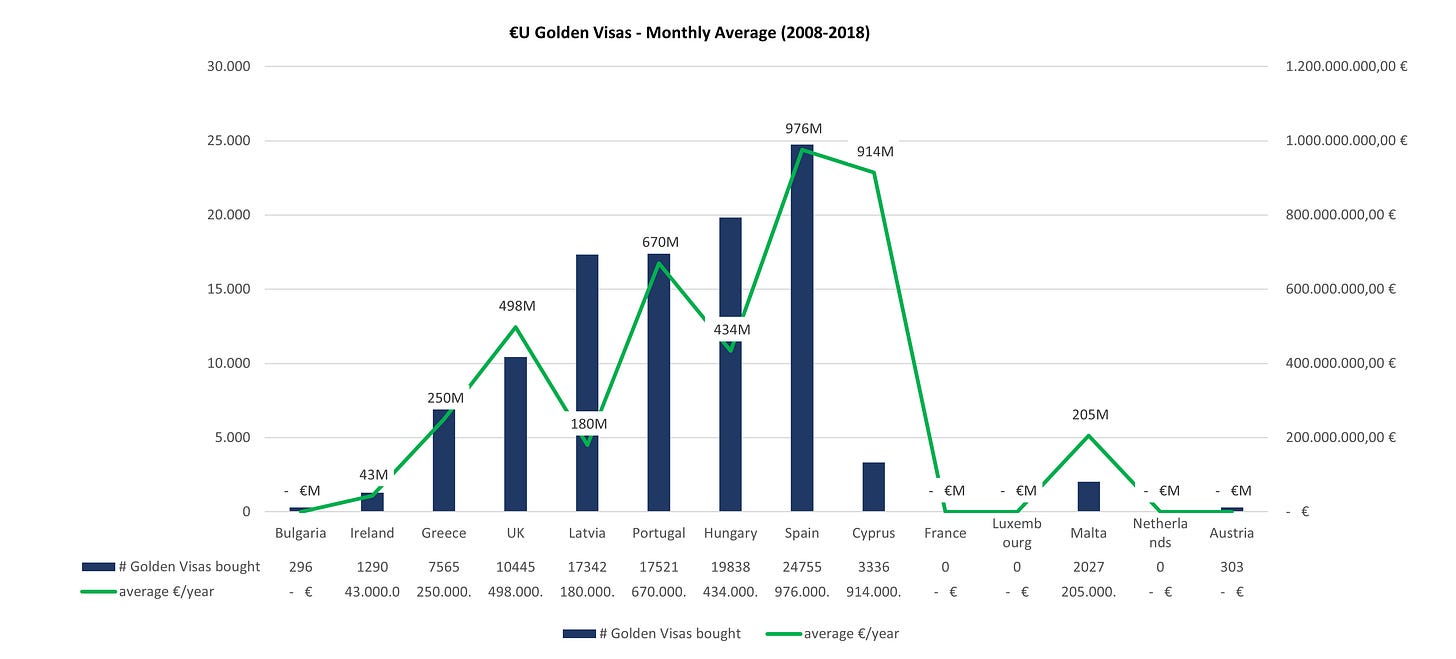

Golden Visa schemes typically require an investment in real estate, business, or government funds. Here’s a snapshot of the most accessible and high-end programs:

Affordable Entry Points

Latvia 🇱🇻 – Minimum investment: €60,000

Thailand 🇹🇭 – Privilege Residence Program: $18,000

Greece 🇬🇷 – Real estate investment: €250,000 (increasing to €500K in certain areas)

For Ultra-High-Net-Worth Investors

Singapore 🇸🇬 – Global Investor Program: SGD 2.5 million

Switzerland 🇨🇭 – Minimum lump sum tax contribution: CHF 250,000+

UAE 🇦🇪 – Business investment: AED 2 million (approx. $545,000)

🌎 The Global Outlook for Golden Visas

While many countries embrace Golden Visa programs for economic growth, others are tightening restrictions:

Portugal & Spain: Reviewing real estate thresholds to prevent housing market inflation.

UK & Canada: Terminated investor visa programs due to security concerns.

EU-wide scrutiny: The European Commission is evaluating the long-term impact of residency-by-investment schemes.

The key takeaway? Investors are prioritising political stability, tax efficiency, and access to world-class infrastructure when selecting their next residency.

🎨 Artful Revelations

Here are some of my picks for the week

📚 Exploring books:

The Bookshop, The Draper, The Candlestick Maker: A History of the High Street by Annie Gray

Annie Gray’s The Bookshop, The Draper, The Candlestick Maker is an ambitious exploration of Britain’s high streets, blending social history with literary verve. At its core, the book seeks to reanimate the lives of shopkeepers and their customers, tracing the evolution of commerce from local necessity to cultural institution.

Gray’s prose is sharp and often playful, balancing academic rigour with narrative fluency. She wields historical detail with precision, ensuring that anecdote never outweighs analysis. The book is structured thematically rather than chronologically, a choice that enriches rather than confuses. By focusing on distinct trades, Gray allows the reader to appreciate not just the economic shifts but also the changing rhythms of daily life.

Ultimately, it succeeds as a richly detailed cultural history, offering both insight and amusement. It is a compelling study of how the spaces we shop in shape the way we live, told with wit and a keen sense of character.

🖼️ Exploring the gallery:

John Singer Sargent’s Madame X (1883) is a masterclass in portraiture, where technical virtuosity meets the complexities of public perception. The painting’s controlled yet dynamic composition—a three-quarter profile set against an ambiguous, nearly abstract background—demonstrates Sargent’s command of both classical balance and modern stylisation.

The subject, Virginie Amélie Avegno Gautreau, is rendered with an almost sculptural precision. Sargent’s handling of light and shadow sculpts her alabaster skin, creating a striking contrast against the deep black of her gown. The fabric’s sharp highlights, achieved through a high-oil glaze technique, reinforce its materiality, while the soft modelling of her skin suggests an almost unsettling lifelikeness. The notorious strap—originally painted slipping off the shoulder and later repositioned—serves as a focal point of tension, emblematic of the fine line between elegance and impropriety.

Sargent’s brushwork is a study in contrasts: fluid yet controlled, rich in texture yet never overwrought. His background, often overlooked, is a muted tonal field, subtly dissolving the figure’s outline and drawing attention to her posture’s assertive yet enigmatic presence. The composition’s asymmetry and the subject’s averted gaze further heighten the sense of detachment, aligning Madame X with the aesthetics of both classical portraiture and burgeoning modernism.

💭 Brainwaves and Whimsy.

It's not so much that you choose a city; it's the city that decides whether or not you belong.

Camel milk. Still a four legged (albeit hoofed) mammal, but in my TCK brain ≠ as other four legged mammal milk (cow and goat) 😂

I am not ready for a desert summer.

Thanks for tuning in after a brief pause. More to come in the next issue of Brevity Margin!

Wishing you a productive week ahead filled with pockets of laughter.

Abigail