Good evening, BM readers 👋

It’s Tuesday, October 15, and here’s your succinct yet insightful weekly briefing 🚀

🎉 We’re halfway to 100! Thank you for being part of this journey. Brevity Margin remains committed to providing you with the insights you need to navigate the ever-evolving global landscape.

"Someone's sitting in the shade today because someone planted a tree a long time ago."

Warren Buffett

🏁 Quick Quips

💰 TD Bank Settles $3 Billion Penalty in Historic Money Laundering Case (CNBC)

TD Bank pleaded guilty on Thursday to multiple criminal charges and agreed to a record-breaking $3 billion in fines and penalties for failing to monitor money laundering activities by drug traffickers and other criminals. Over a six-year period, the bank neglected to oversee $18.3 trillion in transactions, enabling more than $670 million to be laundered through its U.S. branches by criminal networks. These lapses facilitated illegal activities such as drug trafficking, terrorist financing, and human trafficking. The involvement of five TD Bank employees, coupled with senior executives—including the Chief Anti-Money Laundering (AML) Officer—failing to address known issues, highlights critical internal control deficiencies. The $3 billion settlement includes $1.8 billion paid to the Department of Justice (DOJ) and $1.3 billion to the Financial Crimes Enforcement Network (FinCEN), the largest fine ever imposed by FinCEN. In addition, the Office of the Comptroller of the Currency (OCC) has capped TD Bank’s U.S. assets, restricting future growth until compliance improvements are achieved. This regulatory action mirrors that of Wells Fargo in 2018 and signals long-term implications for TD Bank’s U.S. operations as it works to restore its reputation and regain regulatory trust.

🇵🇭 Political Dynasties and Celebrity Candidates Set the Stage for the 2025 Philippines Midterm Elections (Straits Times)

The Philippine Commission on Elections (Comelec) has reported 43,033 applications for the upcoming midterm elections on May 2025, where voters will select 12 senators, a district representative, a party-list representative, and various local officials, totalling 18,280 elective positions. While the candidate registration concluded peacefully, it underscored the enduring influence of political dynasties, despite constitutional provisions prohibiting dynasty-building, as only 21.8% of candidates—9,381 individuals—are female. Prominent political families, including the Marcoses and the Dutertes, continue to dominate the landscape, with President Ferdinand Marcos Jr.'s relatives holding various positions and former President Rodrigo Duterte returning to politics as mayoral candidate in Davao City. Additionally, the entry of controversial figures like Apollo Quiboloy, who faces serious legal charges, highlights the blurred lines between crime and candidacy in Philippine politics. The electoral process is further complicated by a new partnership between Comelec and a tech company aimed at enhancing the voting experience, though scepticism regarding its implementation persists. As the political arena prepares for intense competition, the presence of long-standing dynasties and the emergence of new personalities signal both continuity and potential volatility in the governance landscape.

🇨🇳 China's Strategic Warehouse Expansion: A Bid to Rival LME's Metal Pricing (Reuters)

China is positioning itself to challenge the London Metal Exchange (LME) in global metals pricing by establishing metal storage warehouses outside its borders, notably in Singapore. According to a Reuters report, this initiative aims to facilitate the delivery of metals against futures contracts on the newly launched Shanghai Futures Exchange (ShFE), thereby granting Shanghai's contracts the potential for benchmark status. Currently, Chinese firms rely on LME prices for their physical contracts; a successful shift to ShFE pricing could reduce this dependency and necessitate foreign participation in ShFE to influence reference prices, effectively redistributing market power from the West to China. The exchange's strategic plan includes listing warehouses in free-trade zones to store metals, circumventing regulatory hurdles associated with taxation, which would enable rapid registration of these facilities. However, challenges remain, as ShFE has faced declining volumes in copper futures, capturing only 15% of global trading compared to COMEX's 22% last year. The LME is also responding by expanding its warehouse network in Hong Kong and collaborating with ShFE on new contracts priced against its benchmarks. This ongoing shift signals a potential fragmentation of global metals markets as China seeks greater influence in determining prices for the vast quantities of industrial metals it produces and consumes.

🏚 Natural Disasters Drive Private Equity Investments in $200 Billion U.S. Restoration Market (Hyde Park Capital)

Natural disasters are increasingly devastating the United States, driving private equity firms to seize opportunities in the lucrative cleanup sector. The global remediation industry is projected to expand from $70 billion in 2024 to $92 billion by 2029, bolstered by the $200 billion U.S. disaster restoration market, which is expected to grow from $41.30 billion in 2023 to $76.83 billion by 2033 at a CAGR of 6.69%. Historically dominated by small businesses, this sector has consolidated significantly since major events like Hurricane Katrina in 2005. With the rising frequency of hurricanes, the restoration industry is seen as recession-proof, offering stable cash flows. For instance, Hurricane Helene is estimated to have caused $5 billion in commercial property damage, underscoring the sector's profit potential. Mold remediation has evolved into a billion-dollar market, fueled by shifts in construction materials that create ideal conditions for mould growth; after Hurricane Katrina, 46% of surveyed homes showed mould contamination. Companies like Threshold Brands and BELFOR are actively acquiring smaller firms to bolster their market presence, capturing a significant portion of the 65% market share held by top players. However, the industry faces scrutiny over labour practices, including wage theft and hazardous conditions among private equity-owned firms, raising concerns about ethical standards amid growing demand.

P.S. Did someone forward you this email? Subscribe here for free

Global news and Market moves

☢️ Google backs new nuclear-energy startup Kairos Power for AI needs.

🇮🇳 Hyundai India starts US$3.3 billion IPO in country’s largest ever share sale.

🇮🇩 Indonesia orders Apple and Google to block e-commerce app Temu.

🏅 Nobel Prize in Economic Sciences awarded to 3 economists for research on global inequality.

📊 Singapore banks expect lower rates, China stimulus to boost wealth business.

🇩🇪 German leaders demands Israel give assurances it won’t use weapons against civilians.

👾 Microsoft's VP of GenAI research, Sebastian Bubeck to join OpenAI.

✂️ Warren Buffett's Berkshire cuts stake in BofA to below 10%.

💵 Billionaires among high profile investors backing new ‘anti-woke’ university.

🚀 SpaceX's Starship rocket successfully completes 5th un-crewed test flight.

🇯🇵 Japan PM Shigeru Ishiba eyes more renewables, less nuclear in energy mix.

🎾 Tennis legend Rafael Nadal announces upcoming retirement from the sport.

✈️ Airbus lowers targets, issues profit warning amid supply shortages.

🇮🇱🇱🇧 Israeli strike hit two areas in central Beirut, kills 22.

🎧 TikTok owner ByteDance launches US$170 AI earbuds in China.

🌎 AirAsia eyes Africa, Europe, U.S. routes after major restructuring.

🌐 Melinda French Gates launches a $250 million global women’s health fund.

🛢️ bp dumps oil pledge, resets strategy for investor confidence.

💬 HSBC's Generative AI chief warns of overhyped "success theatre" in AI.

➡️ Forecast and Hindsight 👀

Did foresight meet hindsight?

📈 Trade and supply chain resilience— The World Trade Organization (WTO) forecasts global trade growth of 2.7% in 2024, but rising geopolitical tensions and conflicts in the Middle East may hinder this recovery, potentially increasing shipping costs.

Recent geopolitical events have reshuffled global trade patterns, evidenced by a 1.1% contraction in 2023 due to inflation and interest rate hikes.

Disruptions in the Taiwan Strait could escalate costs and delays across global supply chains, making the maintenance of cross-strait stability crucial for the international economy.

China sends $1.3 trillion annually through the strait.

Nearly one-third of Japan's and Korea's imports transit here, with Japan relying on it for 95% of its crude oil.

The Democratic Republic of Congo exports 70% of its trade through the strait, highlighting its significance for emerging markets.

The nine BRICS nations depend on the strait for about 14% of their imports and 15% of their exports, underscoring its importance beyond just regional economies.

🛢️ Oil price volatility— Crude oil prices fell sharply today following reports that Israel would not target Iranian oil facilities in its retaliatory military strategy, effectively diminishing the geopolitical premium that had previously supported oil prices.

Compounding this bearish sentiment, Chinese consumer prices for September disappointed traders, indicating weak demand from a major consumer market.

OPEC's latest report revised global oil demand growth expectations down to 1.93 million barrels per day (bpd) for 2024, a reduction of 106,000 bpd from last month.

The forecast for China's oil demand growth was also lowered to 580,000 bpd from 650,000 bpd.

Further exacerbating the situation, China's crude oil imports dropped by 3% year-to-date and fell by over 7% from August, as refineries entered planned maintenance amid weak margins.

These factors together signal a bearish outlook for the oil market moving forward.

🌐 IMF and World Bank annual meetings— The World Bank Group (WBG) and International Monetary Fund (IMF) will hold their 2024 Annual Meetings from October 21-26 in Washington, DC.

Climate finance focus: Advocacy will highlight the need for effective Management Action Plans (MAPs) and Dispute Resolution agreements for communities affected by development projects.

Major economies face negative cyclical conditions; global GDP growth is projected at 3.2%, with CPI slowing to 5.9% in 2024.

The external debt stock of low- and middle-income countries has surpassed $3.1 trillion.

Key issues to address:

G20 should agree on coordinated monetary easing, especially interest rate cuts, to support a global soft landing.

WBG aims for 45% of lending to climate actions by 2025, with an estimated $2.4 trillion annual funding need for emerging markets until 2030.

The IMF has increased quota contributions by 50%, raising lending capacity to $960 billion and reviewing quota formulas for legitimacy among developing nations.

The IMF advocates for a plurilateral approach to trade agreements, addressing costs from geo-economic fragmentation and urging major economies to limit negative impacts on low-income countries.

What to look out for this coming week?

📢 TikTok layoffs and AI content moderation

♻️ Renewable energy projects and policy capacity

📑 Crypto regulation

📊 The Week in Numbers

Human Life Expectancy: Optimism vs. Pessimism 🌍⏳

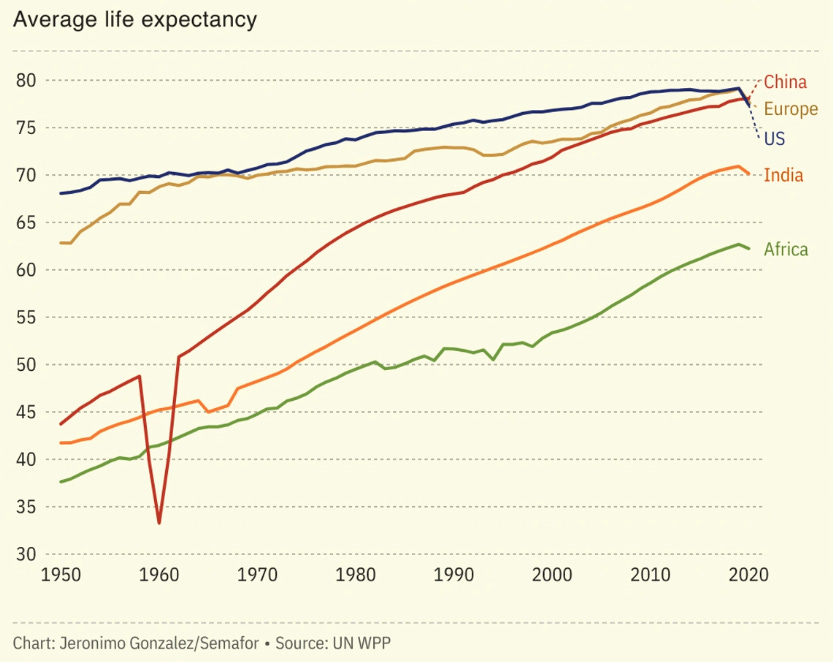

Over the last century, human life expectancy has undergone a remarkable transformation. Individuals born at the turn of the 21st century are expected to live, on average, 30 years longer than those born in 1900, with many celebrating their 100th birthdays. This incredible advancement in lifespan—approximately three additional months of life expectancy gained for every passing year—has been attributed to various medical innovations and public health measures.

However, recent studies indicate that this trend may be plateauing, leading to a heated debate among researchers and policymakers regarding the future of human longevity.

📉 A Slowing Increase in Life Expectancy

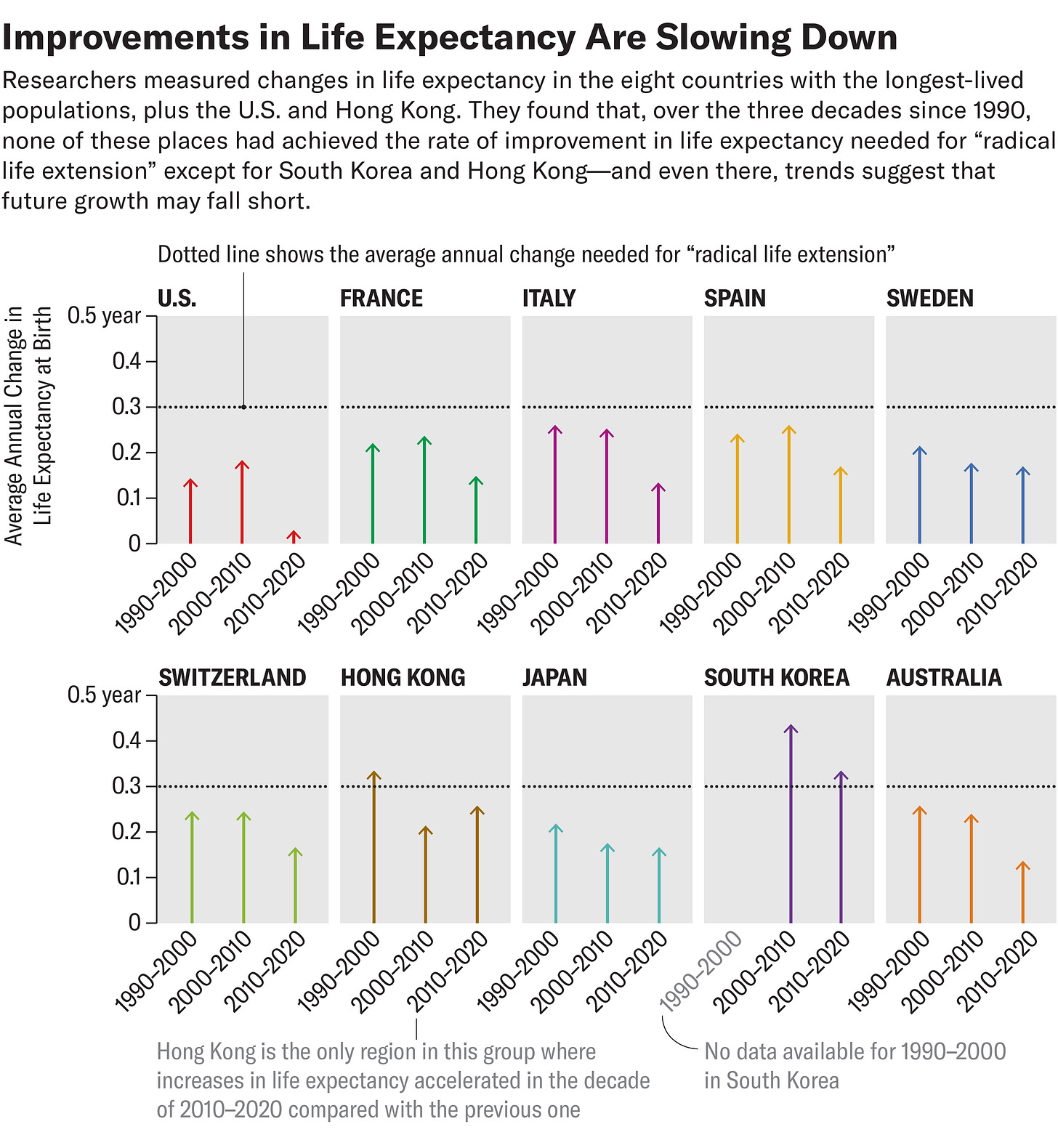

A study analysing life expectancy data from 1990 to 2019 across eight of the longest-living countries—including Japan, South Korea, and Sweden—reveals a concerning trend: the rate of improvement in overall life expectancy is slowing down, with particularly stark declines observed in the United States. Key statistics from the study include:

Percentage of children expected to live to 100

Females: 15% (globally), 3.1% (US)

Males: 5% (globally), 1.3% (US)

Life expectancy increases since 1950

Continuous growth until 2019, but recent years show a plateau or decline.

Countries with better outcomes

South Korea and Hong Kong displayed less dramatic downturns in life expectancy.

👉 Implications of Slowing Life Expectancy

The findings suggest a significant shift in our understanding of longevity. Notably, S. Jay Olshansky, a leading researcher in the field, posits that:

"Most people alive today at older ages are living on time that was manufactured by medicine."

This raises questions about the sustainability of current healthcare advancements and whether they can continue to prolong life.

🤔💭 Diverging Perspectives: Optimists vs. Pessimists

⬆️ Optimists: Hope for Continued Gains

Proponents of longevity research argue that medical advancements, including engineered immune cells and improved imaging technologies, could maintain or even accelerate increases in life expectancy.

Development of immunotherapy for cancer

Innovations in organ transplants and smart implants

Enhanced medical imaging for early disease detection

⬇️ Pessimists: Confronting Biological Limits

Conversely, sceptics argue that biological processes inherently limit human lifespan. They highlight the inevitable deterioration of bodily functions and the challenge of combatting age-related diseases.

Limitations of Current Interventions:

Ageing processes lead to frailty, dementia, and heart disease.

Treatments tend to provide only temporary relief rather than long-term solutions.

📌 The future of human life expectancy remains uncertain, with the potential for continued advancements tempered by the realities of biological limits.

🎨 Artful Revelations

Here are some of my picks for the week

📚 Exploring books:

The Alignment Problem: Machine Learning and Human Values by Brian Christian

Brian Christian’s The Alignment Problem: Machine Learning and Human Values is an exploration of the intricate relationship between artificial intelligence and human ethics. Christian meticulously dissects the philosophical underpinnings and technical challenges inherent in aligning machine learning systems with human values.

The book deftly balances technical rigour with accessible prose, making complex algorithms and theoretical concepts understandable for a broader audience. Christian's approach is not merely descriptive; he engages the reader in a dialogue about the moral implications of AI, raising questions that resonate deeply in today’s digital landscape. His examination of case studies—from autonomous vehicles to AI in healthcare—illustrates the real-world consequences of misalignment, serving as a sobering reminder of the stakes involved.

In summary, The Alignment Problem is not only an enlightening read but also a vital contribution to the discourse on the future of AI. Christian's ability to interweave narrative and analysis renders this book essential for anyone invested in the ethical implications of technology. It challenges readers to consider how we might safeguard our values in an age increasingly shaped by algorithms, urging a collective re-examination of what it means to be human in a world dominated by machines.

🖼️ Exploring the gallery:

Johannes Vermeer’s "The Little Street," painted circa 1657, encapsulates the serene beauty of urban life in the Dutch Golden Age, showcasing the artist’s masterful command of light, perspective, and domestic intimacy. This landscape painting offers a glimpse into the daily rhythms of life, portraying a quiet street scene that invites viewers into the private world of its inhabitants.

The composition is anchored by a meticulously rendered façade of a house, with its warm earth tones contrasted against the cool blue sky. Vermeer’s use of colour is particularly striking; he employs a limited palette that evokes a sense of harmony and unity, while also highlighting the subtle variations in light and shadow. The soft interplay of natural light illuminating the building's surface creates a palpable sense of depth and dimension, drawing attention to the architectural details that define the space.

Vermeer’s mastery of perspective is evident in the way he guides the viewer’s eye through the composition. The narrowness of the street, flanked by the buildings, creates a sense of intimacy and enclosure, while the open sky above invites a feeling of expansiveness. This juxtaposition reflects Vermeer’s ability to balance the confined space of domestic life with the vastness of the world beyond.

An attention to the ordinary, coupled with Vermeer’s characteristic attention to detail, reveals the beauty inherent in everyday activities, elevating the mundane to the realm of art.

💭 Brainwaves and Whimsy.

It’s important to take personal supplements for your needs and not to copy other people. It’s also important not to take too many at the same time as you lose the benefits.

Knowledge is power, but half-truths are lies.

I started noticing how my friends and I have been managing screen time by making our phones slightly more annoying to use. Time to bring back telephone booths?

Thanks for being here. I'll see you next week with the newest issue of Brevity Margin!

Wishing you a productive week ahead filled with pockets of laughter.

Abigail

Well done on this amazing milestone! 🔥