Good evening, BM readers 👋

It’s Wednesday, September 18, and here’s your succinct yet insightful weekly briefing 🚀

"You are now, and you do become, what you think about."

Earl Nightingale

🏁 Quick Quips

🇨🇳 PwC Sanctioned as China Tightens Grip on Financial Oversight Post-Evergrande (AP)

Chinese regulators have imposed a six-month ban and a record 441 million yuan (US$62.2 million) fine on PwC Zhong Tian, the China unit of PwC, for failing to detect false accounting by the now-bankrupt Evergrande Group. PwC audited Evergrande’s accounts for 14 years, yet failed to identify that many real estate projects were inaccurately reported, with some sites still undeveloped despite being listed as complete. The Ministry of Finance cited "serious defects" in PwC’s audit procedures and lack of "professional scepticism" in detecting Evergrande’s inflated revenues, which totalled nearly $80 billion during 2019-2020. The China Securities Regulatory Commission found that PwC’s audit of Evergrande was "seriously unreliable," with 88% of records inconsistent with actual project developments. This crackdown follows China’s broader effort to regulate excessive borrowing amid its property market crisis. PwC has fired 11 employees involved in the audit, and while the firm expressed full cooperation with the investigation, this marks the most severe punishment for an international audit firm in China to date, signalling a tightening regulatory environment for financial oversight.

📺 The Future of Fox and News Corp: Murdoch Family's Power Struggle Unfolds (NPR)

A significant court battle over the control of Rupert Murdoch’s $18.6 billion family trust has commenced in Nevada, with major implications for the future of News Corp, Fox News, and the global media landscape. The case pits the 93-year-old media mogul against three of his children—Prudence, Elisabeth, and James—as they contest Murdoch’s efforts to give his son Lachlan full control of the family’s media empire. Established in 1999 during Murdoch’s divorce from his second wife, the family trust originally split control between his four eldest children. However, Murdoch now seeks to modify the “irrevocable” trust to ensure Lachlan's dominance, a move that reflects internal family political divides. Lachlan is known for his alignment with his father's conservative values and Fox News’ editorial stance, while his siblings, particularly James, lean more moderate and have been critical of the network. The outcome of this trial could range from Lachlan solidifying control and maintaining the status quo, to a potential leadership overhaul or asset sale if the other siblings prevail. Investors and media professionals are watching closely, as the trial could reshape the future direction of some of the world’s most influential media outlets.

🛢️ Brent and WTI Price Estimates Cut as Oversupply Threatens Oil Market Stability (FT)

Macquarie has significantly downgraded its Brent Crude price forecast to $80 per barrel and WTI Crude to $75 per barrel for the remainder of 2024, attributing these adjustments to weaker-than-expected demand and an anticipated market surplus. The bank predicts a substantial oversupply over the next five quarters due to increased non-OPEC+ supply and slow demand growth. Both OPEC and the International Energy Agency (IEA) have also cut their global oil demand projections, with Goldman Sachs and Morgan Stanley recently lowering their oil price estimates. Brent crude, currently at $72.14 per barrel, reflects a broader trend of financial market pessimism, as indicated by a record low in "net length," where more investors are betting on price declines than increases. Despite physical inventories falling, the financial market's negative outlook may lead to increased volatility and potential price swings. With Brent crude recently dipping below $70 per barrel and remaining below $75 for two weeks, the outlook remains uncertain. Analysts highlight that unless demand stabilises or OPEC+ adjusts production strategies, the market may face prolonged oversupply and lower prices.

📉 Adam Neumann’s Flowcarbon Struggles with Carbon Token Rollout, Issues Refunds (TechCrunch)

Flowcarbon, the climate tech venture co-founded by WeWork’s Adam Neumann, is now quietly refunding investors after its ambitious “Goddess Nature Token” failed to launch as planned. Despite raising $70 million in 2022 from prominent investors like Andreessen Horowitz, the startup has struggled to bring its tokenisation of carbon credits to market. This token, intended to represent carbon credits on the blockchain, was aimed at making carbon trading more accessible. However, delays and resistance from carbon registries have hindered its progress, leading to recent refunds. Flowcarbon has cited market conditions and registry issues as reasons for the refunds, which have been accompanied by confidentiality agreements. The company's challenges reflect broader issues in the voluntary carbon market, where inflated claims and regulatory hurdles have undermined credibility. With global carbon credit markets worth approximately $2 billion in 2021 and ongoing scrutiny, Flowcarbon's situation underscores the difficulties in integrating blockchain with carbon offsetting. Investors and stakeholders are advised to monitor developments closely, given the potential impact on the carbon finance sector and related investment opportunities.

P.S. Did someone forward you this email? Subscribe here for free

Global news and Market moves

💵 Microsoft, BlackRock to launch $30bn fund for AI infrastructure.

💳 Apple is in talks with JPMorgan to take over credit card from Goldman Sachs.

🇺🇸 Donald Trump target of second apparent assassination attempt in Florida.

💸 BofA raises its US minimum hourly wage to $24.

🇪🇺 Thierry Breton abruptly resigns as EU’s internal market commissioner.

📂 Tupperware Brands plans to file for bankruptcy, according to Bloomberg.

🇦🇺 Australia, UAE reach trade deal for investment in critical minerals.

✈️ Boeing announces hiring freeze, sweeping cost cuts.

🇷🇺 President Vladimir Putin orders bolstering of Russia's military to 1.5m troops.

⛏️ Alcoa to sell its 25.1% stake in Ma’aden joint venture to Ma’aden for $1.1bn.

🇵🇰 U.S. sanctions on Chinese tech firms threaten Pakistan defense ties.

👂 US regulators approved the use of Apple AirPods as OTC hearing aid.

🇵🇱 Poland submits applications for $10bn worth of EU recovery funds.

🚀 Britain’s Revolut preparing to expand business operations in India in 2025.

🤖 OpenAI announces a new AI model, o1 with ‘reasoning’ abilities.

💰 Skype founder's VC firm raises $1.24bn to back European tech startups.

🇬🇧 London’s Oxford Street to be pedestrianised under new mayoral plans.

☕ Rising theft in Uganda amid soaring global coffee prices.

🇻🇦 Pope Francis concluded his 12-day tour of Southeast Asia and Oceania.

🏝 Pacific island nations lodged a formal submission to the ICC to make ecocide a criminal offence.

➡️ Forecast and Hindsight 👀

Did foresight meet hindsight?

🌊 South China Sea developments—China continues to claim Sabina Shoal and has been aggressive towards Philippine vessels, raising concerns about potential US involvement in the conflict.

The US continues to back the Philippines but faces criticism for not providing sufficient support, with some viewing its actions as insufficient.

Australian Ambassador HK Yu announced increased maritime activities with the Philippines to support a free and open Indo-Pacific.

The Philippines will conduct regular maritime cooperative activities to stabilise the South China Sea. The BRP Teresa Magbanua was recently withdrawn from Sabina Shoal due to operational issues.

Chinese experts view Philippine actions as provocations and warn of stricter countermeasures.

💰AI capital spending—Generative AI has triggered a historic spending boom in the US, with companies and investors committing hundreds of billions of dollars in anticipation of substantial future profits. Major tech firms are investing heavily in AI infrastructure, including data centres and hardware.

Microsoft has doubled its data centres since early 2020, Google has increased its total by 80%, and Oracle plans to add 100 new centres.

AI-optimised data centres are more power-intensive due to the high energy demands of AI chips.

Companies like Meta Platforms and Tesla are competing for large GPU allocations, with Meta aiming for 600,000 GPUs by end of 2024 and Tesla targeting 300,000 GPUs by next summer.

Sequoia Capital estimates that AI firms need to generate $600 billion in revenue to justify current spending on data centres and chips. Current AI revenue is estimated to be in the tens of billions.

📈 E-commerce growth in Thailand and Vietnam—Strategic Chinese warehouse projects near the Vietnam-China border are boosting cross-border trade and increasing competition for Vietnamese businesses. Warehouse market in Vietnam has seen an impressive annual growth rate of 23% from 2020 to 2023.

By the end of 2023, foreign developers controlled over 75% of warehouse rental space, a significant shift from domestic firms which hold only 25%.

Future projections indicate a sustained annual growth rate of 7% until 2027, driven by continued manufacturing and retail expansion.

Thailand’s e-commerce sector is on track to reach 750 billion baht by 2025, up from 634 billion baht in 2023 and 700 billion baht projected for 2024.

There were 7,393 e-commerce businesses registered in 2024 with a combined capital of 43.7 billion baht, a significant increase from 1,713 businesses with 2.27 billion baht in 2023.

The Thai Department of Business Development has partnered with platforms such as TikTok Shop, Shopee, Lazada, and NocNoc to support online commerce.

As of January 2024, Thailand has 63.2 million internet users, representing an 88% penetration rate.

What to look out for this coming week?

🌐 44th and 45th ASEAN Summits and Related Summits

🇸🇬 Singapore’s decarbonization leadership plans

👩🏻💼 Women and C-suite gains

📊 The Week in Numbers

🏝️ Trouble in Paradise: A Looming Default on Islamic Sukuk

The Maldives is on the brink of a historic financial crisis that could test the resilience of the global Islamic finance market. With its significant debt burden and dwindling reserves, the archipelago nation faces the possibility of defaulting on a key form of Sharia-compliant debt.

This impending crisis could make it the first sovereign nation to default on sukuk, a form of Islamic bond, which has never happened before.

📉 Current Financial Situation

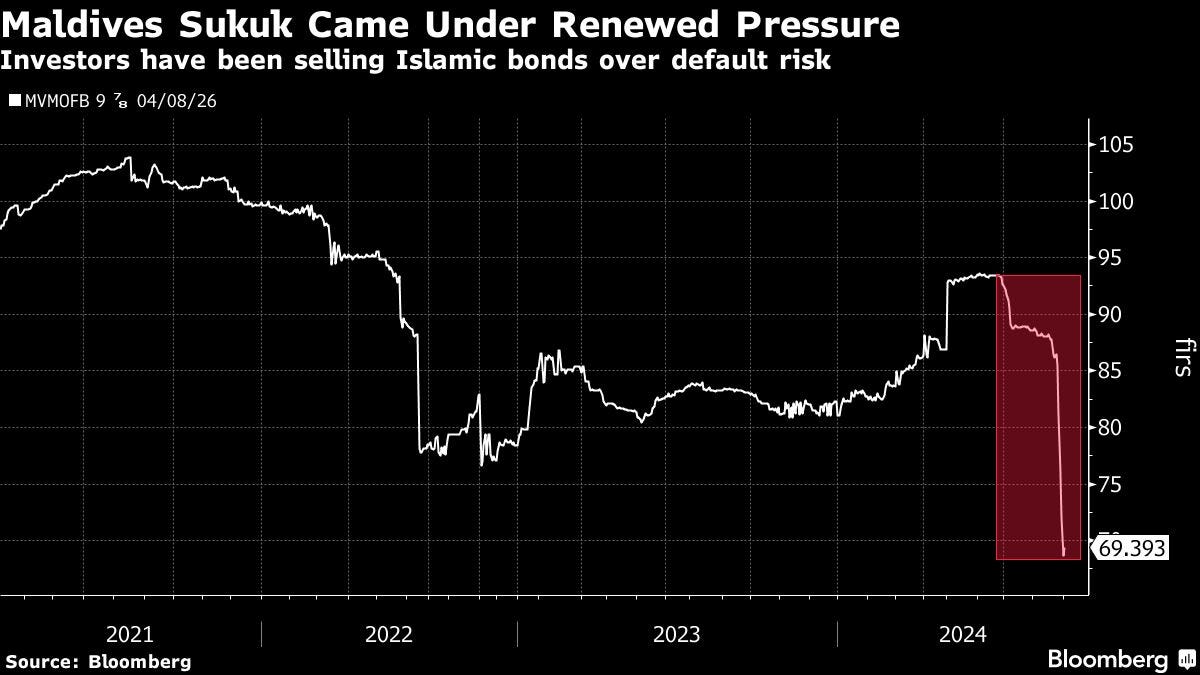

Bond Performance

Sukuk Bond Price: The price of the Maldives' $500 million sukuk bond has plummeted to approximately $0.70 on the dollar over the past month. This dramatic decline reflects the growing fears of a potential default.

Yield: The bond currently yields around 40%, a stark increase from its previous levels, indicating high-risk perceptions among investors.

Foreign Reserves and Debt

Foreign Reserves: The Maldives' reserves have dwindled to about $500 million, with only $50 million in liquid assets, barely sufficient for one month of external payments.

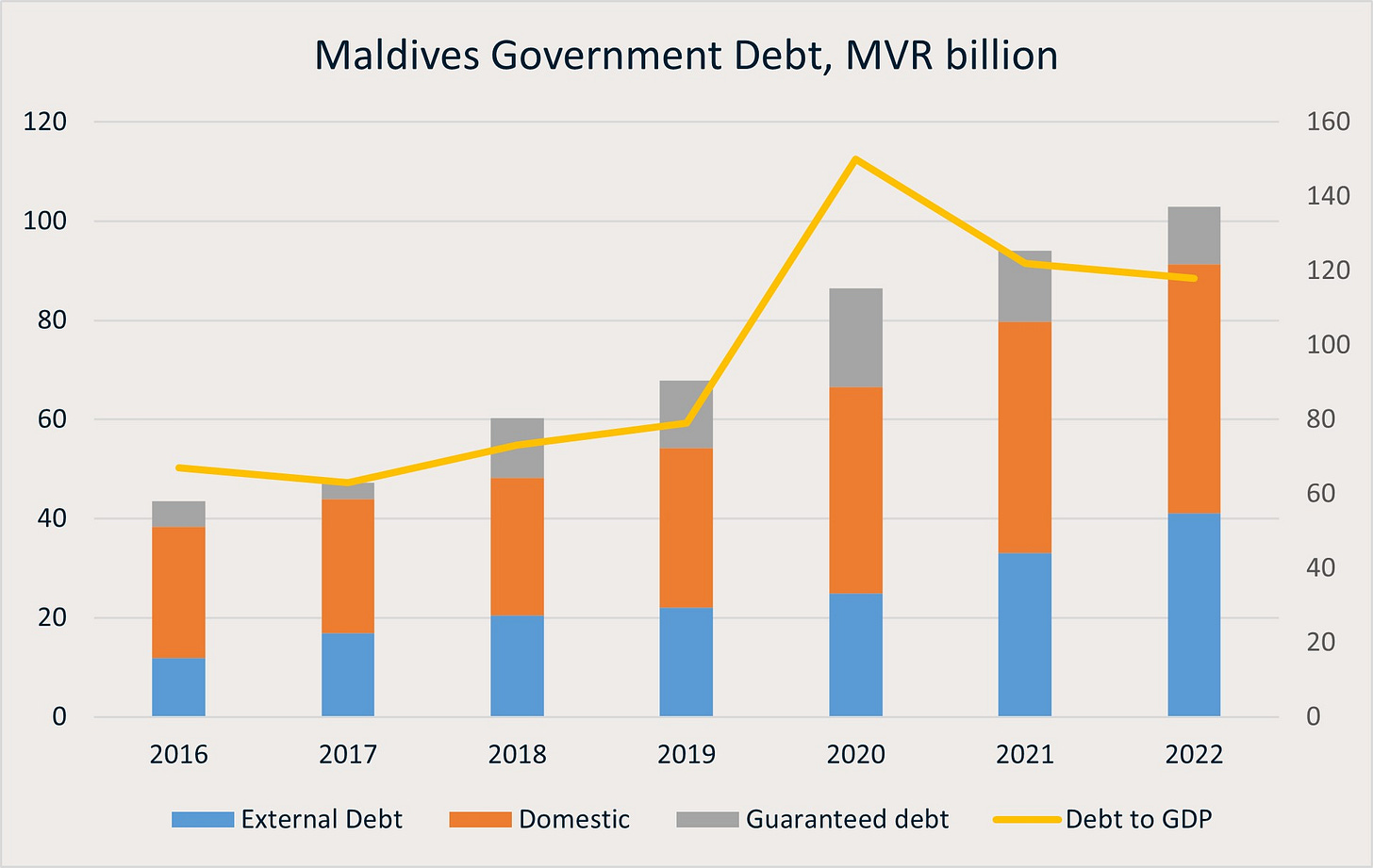

Debt Payments Due: The country faces $400 million in external debt payments this year, rising to $550 million in 2025 and $1 billion in 2026, including sukuk redemption.

🌏 International Relations and Economic Implications

Bilateral Debt and Relationships

Major Creditors: The Maldives owes approximately $1.37 billion to China and $124 million to India. These nations have been key bilateral creditors and have significant influence over the island nation's financial stability.

China’s Support: Recently, China agreed to strengthen trade and investment with the Maldives, showing its support amid the financial crisis. This move is part of China’s broader strategy to increase its influence in the Indian Ocean region.

Political and Economic Context

New Government: President Mohamed Muizzu, elected in April, has shifted the country’s focus towards China, moving away from India. His administration’s pro-China stance includes a $500 million infrastructure project and strained relations with India.

Tourism Sector: The Maldives' tourism industry, a crucial revenue source, is recovering, with visitor numbers expected to surpass two million this year. However, this growth is not sufficient to offset the mounting debt.

📊 Rating Agencies and Market Reactions

Credit Ratings and Default Risks

Rating Downgrades: Fitch Ratings has downgraded the Maldives' credit rating from B to CCC, and then to CC, reflecting severe default risks.

Market Sentiment: Despite recent improvements, including a rebound in sukuk prices, Moody's has warned that a default remains a strong possibility due to inadequate reserves.

Economic Indicators

Debt-to-GDP Ratio: The Maldives' debt-to-GDP ratio stands at 120%, exacerbated by the risk of currency depreciation if the peg to the U.S. dollar is abandoned.

Inflation and Growth: Inflation is expected to remain below 5%, while GDP growth is projected to be around 5% this year, driven by tourism and other sectors.

The Maldives' debt crisis represents a significant test for the Islamic finance sector, particularly as the nation grapples with potential sukuk default. The unfolding situation highlights the complexities of managing sovereign debt within the framework of Sharia-compliant finance and the broader geopolitical and economic factors at play.

🎨 Artful Revelations

Here are some of my picks for the week

📚 Exploring books:

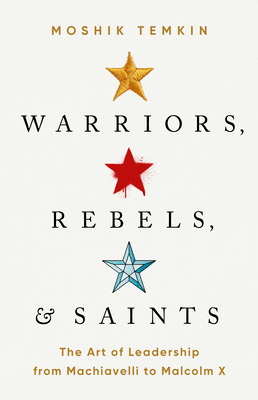

Warriors, Rebels, and Saints: The Art of Leadership from Machiavelli to Malcolm X by Moshik Temkin

Moshik Temkin’s "Warriors, Rebels, and Saints: The Art of Leadership from Machiavelli to Malcolm X" is an exploration of leadership through the lens of history’s most influential figures. Temkin offers a richly textured analysis of how different contexts shape leadership styles and efficacy.

Temkin’s central thesis is that effective leadership cannot be distilled into a single formula but rather emerges from the interplay between individual attributes and the demands of the moment. This perspective allows him to traverse a broad spectrum of historical examples, from the political machinations of Renaissance Italy to the revolutionary fervour of the 20th-century civil rights movement. The book is particularly adept at illustrating how leaders adapt their tactics based on their goals, the constraints they face, and the prevailing cultural and political climates.

Temkin’s insights into the dichotomy between visionary and pragmatic leadership styles are especially thought-provoking. He suggests that while Machiavelli’s approach is often viewed through a cynical lens, it is precisely this strategic ruthlessness that enables leaders to achieve long-term goals. Conversely, Malcolm X’s emphasis on moral clarity and grassroots mobilization demonstrates how ethical considerations can drive revolutionary change. This duality offers readers a nuanced understanding of the balance between moral integrity and strategic necessity in leadership.

The book’s relevance is underscored by its ability to bridge historical insights with contemporary leadership challenges, making it a valuable resource for history buffs and everyday readers alike.

🖼️ Exploring the gallery:

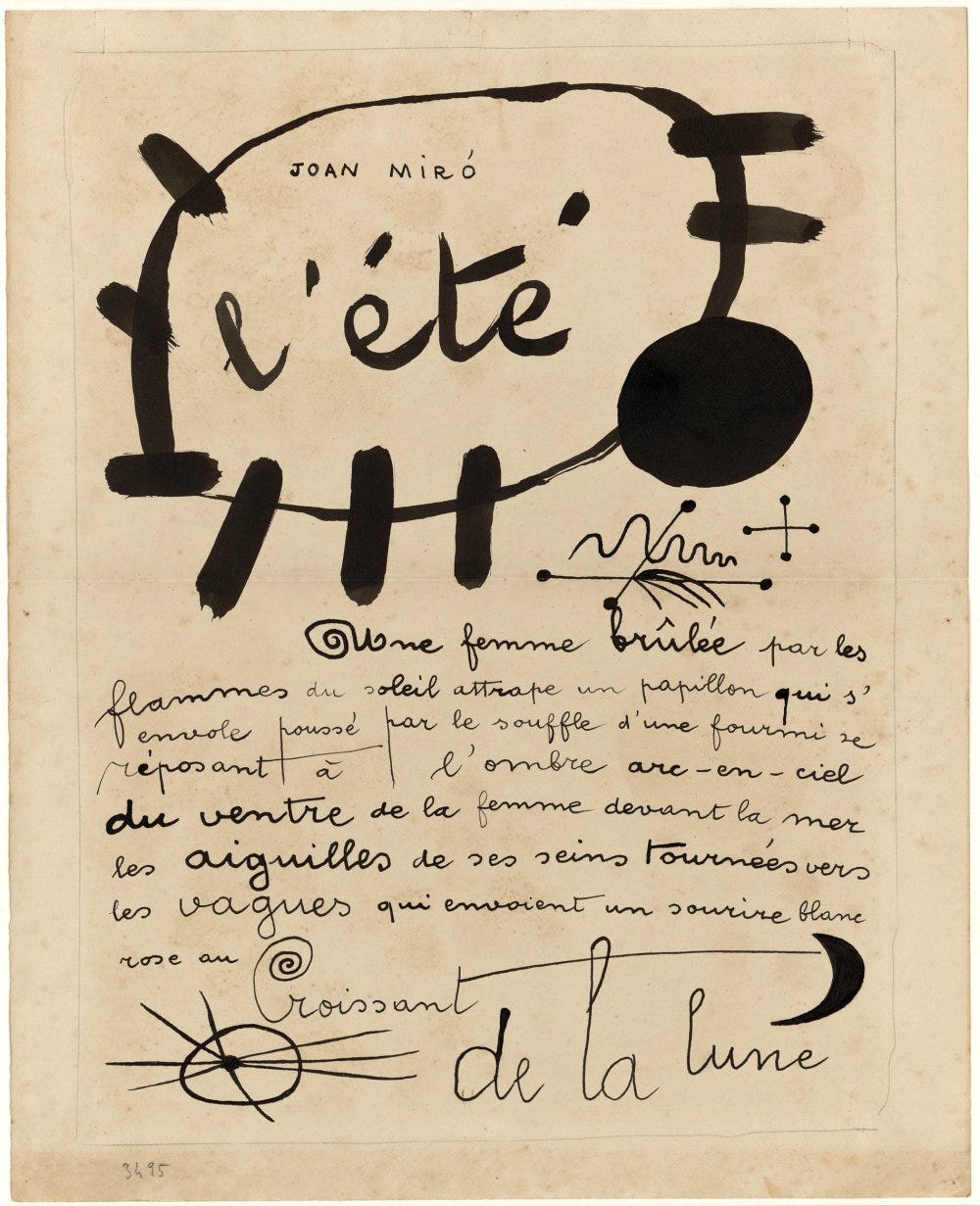

Joan Miró's "L'Été," created in 1927, is a vivid exploration of surrealist abstraction and lyrical form. This painting exemplifies Miró's distinctive approach, characterised by a playful juxtaposition of organic shapes and vibrant colours against a seemingly chaotic backdrop.

The composition is both whimsical and precise, with Miró's characteristic use of bold, primary colours creating a striking contrast with the softer, pastel tones. His deft application of line and form generates a sense of rhythmic movement, as the abstract shapes and symbols float freely within the canvas space.

Miró employs a limited but dynamic colour palette, using saturated reds, yellows, and blues to infuse the work with energy and vitality. The painting’s background, rendered in a subtle gradient, enhances the floating quality of the foreground elements, reinforcing the surrealist influence.

The technical execution of "L'Été" reveals Miró’s adeptness at blending spontaneity with structure. Through this work, Miró effectively captures the essence of summer—both its warmth and its boundless, liberating energy—while also showcasing his innovative contributions to modernist art.

💭 Brainwaves and Whimsy.

Love Next Door has been my kdrama escapism of choice for the final leg of 3Q.

Why do we get so judgmental about other people's weddings? 😂

“It is not the absence of discomfort, but the capacity to live in the fullness of the human heart and wide range of emotional experience.”

Thanks for being here. I'll see you next week with the newest issue of Brevity Margin!

Wishing you a productive week ahead filled with pockets of laughter.

Abigail