Good afternoon 👋

It’s Wednesday, June 19, and here’s your succinct yet insightful weekly briefing 🚀

“If we will be quiet and ready enough, we shall find compensation in every disappointment.”

Henry David Thoreau

🏁 Quick Quips

Here’s a recap of last week’s headlines

🇨🇳🇵🇪 Beijing's $3.5 Billion Megaport in Peru Set to Boost Trade with Asia (WSJ)

China is expanding its global influence by constructing a $3.5 billion deep-water port in Chancay, Peru, expected to be inaugurated by President Xi Jinping this year. This port, built by Cosco Shipping, will be the first on South America's Pacific coast capable of accommodating mega ships with its nearly 60 feet depth, enhancing trade between Asia and South America and particularly benefiting Chinese electric vehicle exports. The US views this as a strategic challenge, fearing it will strengthen China's control over South America's resources. The Chancay port, 70% complete and slated for inauguration during the APEC summit in November, is expected to cut shipping time from 35 days to 23 days, reducing costs and opening new Asian markets for Peruvian exports. Additionally, Peru has awarded a $405 million contract to Chinese firm Jinzhao for another port, aiming to reactivate $15 billion worth of mining projects. President Dina Boluarte of Peru is scheduled to visit China on June 28 to meet with Xi Jinping and executives from key Chinese firms involved in these infrastructure projects.

🇻🇪 Foreign Credit Cards Bolster Venezuela's Currency Control Amid Inflation Battle (Reuters)

Foreign credit card transactions are increasingly vital in circulating foreign currency within Venezuela, aiding the government's efforts to control inflation and maintain a fixed exchange rate. Since President Nicolas Maduro relaxed currency controls five years ago, allowing greater use of U.S. dollars alongside the bolivar, these transactions have grown steadily, now comprising 11% of retail sales, up from 8% last year. Local banks convert approximately $60 million monthly from these transactions into bolivars, supporting the limited supply of foreign currency and helping maintain the exchange rate at 36.4 bolivars per dollar. This influx helps mitigate inflation, which was 59.2% over the past year. Despite U.S. sanctions primarily targeting the government and oil sector, foreign card transactions continue to provide crucial economic support, especially as credit restrictions on bolivar-denominated cards limit access to local currency.

🇮🇹 Exclusion of Italian PM from EU Leadership Talks Signals Strategic Power Plays (FT)

Italian PM Giorgia Meloni's exclusion from key EU leadership discussions has sparked significant discontent and may complicate securing a swift agreement on the bloc’s future priorities. During a private dinner, the EU’s 27 leaders discussed nominating Ursula von der Leyen for a second term as European Commission president and other key appointments. Tensions rose when Meloni was excluded from a closed-door meeting of leaders from the EU’s three largest political parties. This exclusion drew sharp criticism from Meloni, who lambasted leaders like Emmanuel Macron and Olaf Scholz for sidelining her. Renew Europe, led by Macron's party, has claimed the post of EU top diplomat, but this could be contested if Meloni’s ECR allies with Marine Le Pen's Identity and Democracy group and Hungarian PM Viktor Orbán’s party.

The decision on appointments, made by a qualified majority, could theoretically proceed without Meloni or Orbán. However, isolating Meloni might drive her to align with Le Pen, potentially derailing other decisions. The strategic exclusion of Meloni risks broader conflict and complicates von der Leyen’s efforts to secure a parliamentary majority for her reappointment. This could backfire as Meloni aims to secure significant portfolios for Italy in the European Commission, highlighting the high stakes and complexity of EU political negotiations.

🇮🇩 Bank Indonesia Intervenes as Rupiah Hits Lowest Level Since 2020 (Tempo)

Indonesia's central bank intervened in the foreign exchange market to defend the rupiah, which fell to a four-year low of 16,415 per dollar. Bank Indonesia (BI) Governor Perry Warjiyo confirmed the intervention, stating measures are in place to stabilise the currency, which skidded 0.9% before partially recovering. Despite the decline, Warjiyo noted the rupiah's depreciation rate is lower than other emerging market currencies like the Thai baht and South Korean won. In response to a sharp drop in April, BI unexpectedly raised interest rates and has increased rates by 275 basis points since mid-2022. The recent decline is linked to expectations of prolonged high US interest rates and concerns over Indonesia's fiscal policy under President-elect Prabowo Subianto. Bloomberg reported Prabowo plans to raise the debt-to-GDP ratio to 50%, spooking investors. As a result, BI is less likely to ease monetary policy soon. BI's interventions include the Domestic Non-Delivery Forward market, the spot market, and the government bonds market, aiming to attract foreign inflows and stabilise the currency amidst global economic volatility.

P.S. Did someone forward you this email? Subscribe here for free

Global news and Market moves

🌍 G7 leaders agree to lend Ukraine $50B using frozen Russian assets.

💰 Tesla renews legal fight to reinstate Elon Musk's $56B pay package.

🇨🇳 China's Ant Group lifts R&D spending to nearly $3B on AI, Alipay.

🇵🇭 Philippine Peso to extend slump to record low on rate cut bets.

🍌 Chiquita Banana ordered to pay $38.3M for funding far-right paramilitary.

🛢️ Global demand for oil will peak in 2029, per new IEA forecasts.

⚽ European Championship exposes Deutsche Bahn's underinvestment problem.

✈️ Deutsche Bank buys $1.8B aviation loan portfolio from NordLB.

📈 Nvidia surpasses Microsoft to become world's most valuable company.

🇺🇸 Pentagon reportedly ran secret anti-vax campaign to undermine China during COVID pandemic.

🇷🇺 WSJ reporter Evan Gershkovich to stand trial in Russia on espionage charges.

🏛️ Alex Jones ordered to liquidate assets to pay $1.5B Sandy Hook conspiracy suit.

🇰🇵 Russia’s Vladimir Putin arrives in North Korea for first time since 2000.

🐖 China launches anti-dumping probe into EU pork imports.

🇮🇳 JPMorgan to add India to its biggest emerging-market bond index next week.

👤 Adobe sued by US regulators over hard-to-cancel subscriptions and fees.

🐉 HBO renewed House of the Dragon for a third season.

➡️ Forecast and Hindsight 👀

Did foresight meet hindsight?

📈 Growing debt burden— Emerging nations are now grappling with a staggering $29 trillion in public debt, exacerbated by COVID-19, conflicts, and climate change. A UN report reveals the severity, noting that "15 countries spend more on interest payments than on education" and "46 spend more on debt payments than on health care." Global government debt is now four times higher than in 2000, marking this as potentially the worst debt wave.

Martin Guzmán, former finance minister of Argentina, criticises the IMF's high-interest bailout loans and surcharges, which further strain already struggling economies.

The five largest borrowers — Ukraine, Egypt, Argentina, Ecuador, and Pakistan — paid $2 billion in surcharges last year, raising their borrowing costs by nearly 50%, according to the Center for Economic and Policy Research.

US federal debt is projected to reach 122 percent of the country’s annual economic output, exceeding the post-World War II peak, as reported by The Washington Post.

The Congressional Budget Office's latest report estimates a deficit of $1.9 trillion this fiscal year, with the national debt expected to rise to $50.7 trillion by 2034, up from the previously forecasted $48.3 trillion.

The US currently holds $34.7 trillion in debt, with the majority held by the public through bonds and other instruments.

The African Development Bank’s African Development Institute launched the African Debt Managers Initiative Network (ADMIN) to address Africa’s debt challenges with home-grown solutions.

As of 30 April 2024, 13 out of 38 African countries are at high risk of debt distress, with 6 already in distress. External debt servicing averages 18% of government revenue.

Discussions centred on sound debt management, networking, and peer learning to enhance debt sustainability.

🔥 Climate cost of AI— Natural gas prices have surged significantly due to rising demand from the AI boom and its role in renewable energy transition. Since mid-April, US natural gas futures have risen by about 62%, while Dutch gas futures increased by 18%. Global power demand is expected to rise by a third in the next decade, with natural gas adding 47 gigawatts per year from 2024 to 2035.

Asia’s emerging markets are expected to see significant growth in gas demand due to population growth, industrial development, and decarbonisation efforts.

China’s LNG-fuelled heavy-duty trucks increased by 459% in the first four months of 2024 compared to 2023.

US electricity demand is projected to grow by up to 20% by 2030, driven by AI data centres.

Renewable energy alone cannot meet the rising demands, making natural gas essential, potentially supplying 60% of AI power needs.

Data centres, currently consuming 1-2% of global power, are expected to consume 3-4% by the end of the decade.

Data centre carbon dioxide emissions may more than double between 2022 and 2030.

🌐 G7 summit results—Leaders of G7 member states convened in southern Italy for their annual summit, aiming to address pressing issues including the Ukraine crisis and governance of artificial intelligence (AI).

The group issued a joint communique announcing a plan to utilise frozen Russian assets to secure approximately $50 billion in loans for Ukraine, a move criticised by Russian President Vladimir Putin as "theft".

Disagreements persisted within the G7 over the specifics of the loan arrangement, which are expected to be finalised in subsequent negotiations over the coming months.

Discussions also centred on AI governance, with EU nations advocating for stringent regulations and a legally binding framework, while the US favoured a more permissive approach to foster innovation.

Notably absent from the communique were mentions of disputes such as abortion, which had been contentious among member states.

Pope Francis made a historic address to G7 leaders, urging them to determine whether artificial intelligence (AI) becomes a force for good or a source of terror, and called for a ban on autonomous weapons in warfare.

The summit coincided with domestic political challenges for G7 leaders, including significant setbacks in the 2024 European Parliament Election, where governing parties in several member states faced electoral losses.

What to look out for this coming week?

🌐 Supply chain disruptions and trade policy changes

📈 Central bank decisions

💥 Geopolitical tension: South China Sea, Israel-Lebanon conflict

📊 The Week in Numbers

💸 Defence Dollars: Not Just for Disputes

In the last two decades, Southeast Asian countries have significantly increased their defence spending. This trend is often linked to territorial disputes in the South China Sea and perceived security threats from China. However, it's more accurately a move towards normalising military capabilities and ensuring self-defence adequacy.

🌏 Historical Context

During the Cold War, Southeast Asian nations diverted resources from defence to economic growth, under the security umbrella provided by superpowers. Post-Cold War economic growth and the need for adequate defence capabilities have driven the recent surge in military spending.

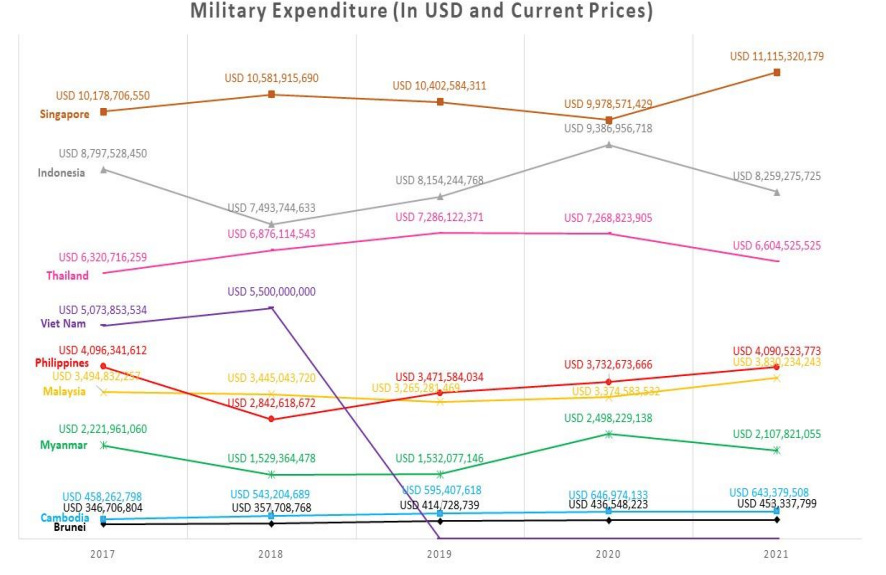

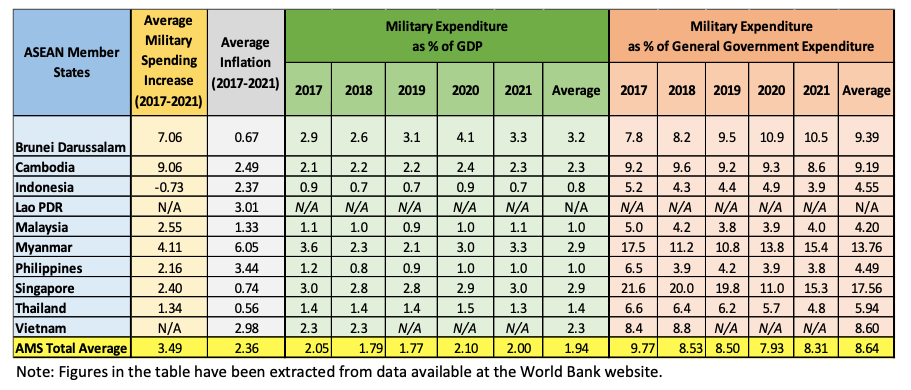

📊 SIPRI Defence Spending Data (2018-2022)

Brunei: 3.09% of GDP.

Singapore: 2.86%.

Myanmar: 2.76%.

Lower Spending: Malaysia, Philippines, Indonesia (below 1% of GDP).

Understanding the regional military dynamics involves considering both spending trends and the broader geopolitical context, highlighting the complex interplay between economic growth, defence modernisation, and strategic partnerships.

📊 Defence Spending Trends (2000-2021)

Indonesia: Increased defence spending by 7.3 times.

Cambodia: 7.9 times increase.

Vietnam: Six times increase.

Singapore: 2.6 times increase, surpassing $10 billion in 2021.

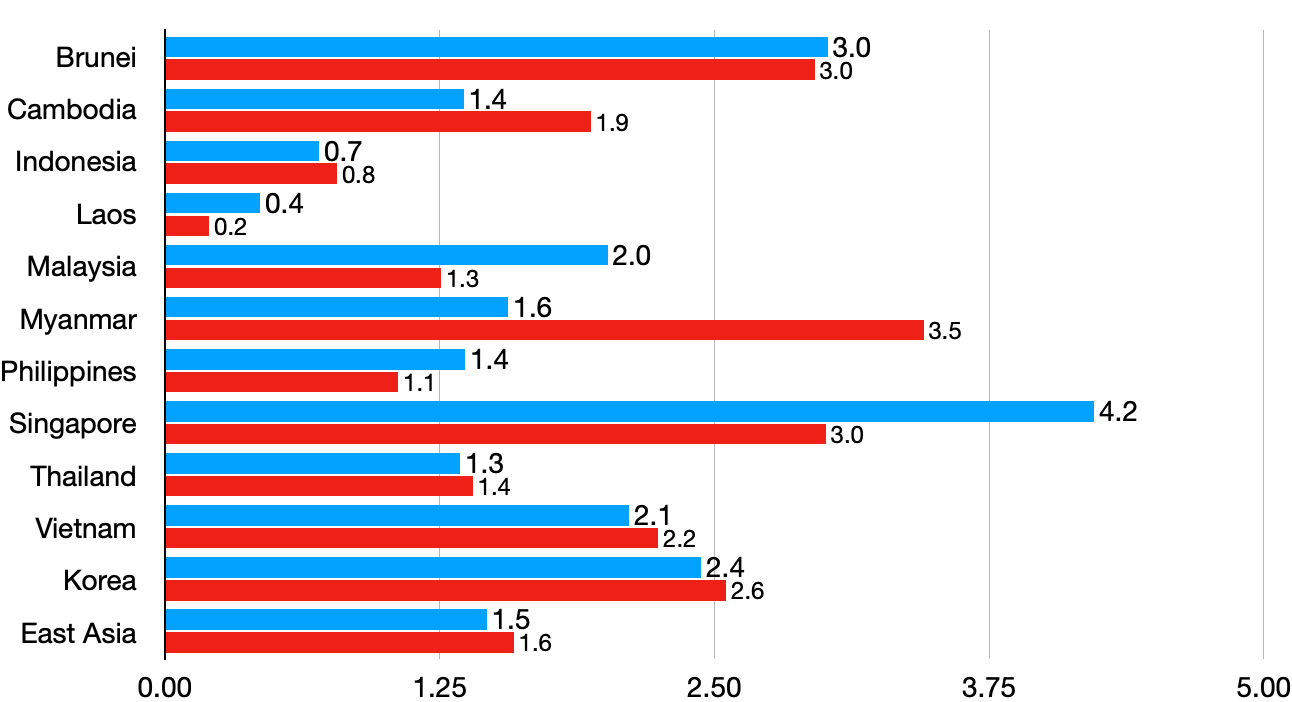

💵 Defence Spending as Percentage of GDP (2000-2021)

Singapore: 4.2% (2000-2010), 3.0% (2011-2021).

Brunei: 3.0%.

Vietnam: 2.1% (2000-2010), 2.24% (2011-2021).

East Asia average: 1.5% (2000-2010), 1.6% (2011-2021).

South Korea: 2.4% (2000-2010), 2.6% (2011-2021).

✍️ It's noteworthy that ASEAN member states like Malaysia, Singapore, and Thailand, which haven't cited territorial disputes as a significant security challenge, have still modestly increased their defence budgets. This suggests that while territorial conflicts can drive defence spending, other factors might also contribute to the rise.

➡️ The fact that these countries, despite not viewing territorial disputes as security threats, have increased their defence spending indicates that additional elements are at play in influencing their military expenditures.

🛡️ Military Modernisation and Strategy

While China's rising power is a concern, Southeast Asia's military build-up is not solely aimed at countering China. Rather, it ensures minimal credible deterrence and the ability to defend sovereignty and territorial waters.

China is the largest defence spender in Asia, comprising 43% of the region's total, with 29 consecutive years of increases. However, military balance involves both quantitative and qualitative factors:

Naval Forces: China has more ships, but the US Navy has superior missile launch capabilities and operational experience.

Global Responsibilities: The US Navy's global commitments mean it cannot concentrate all forces in the Indo-Pacific, unlike China.

➡️ Challenges and Realities

Combined ASEAN Defence Spending: Only one-seventh of China's.

Old Military Equipment: Many Southeast Asian countries have outdated military hardware, necessitating modernisation.

🤝 Network of Partners

The United States has a broad network of alliances in Asia, including Japan, South Korea, Australia, and the Philippines, enhancing its strategic positioning.

🎨 Artful Revelations

Here are some of my picks for the week

📚 Exploring books:

A Decolonial Feminism by Françoise Vergès

Françoise Vergès' "A Decolonial Feminism" challenges conventional narratives by weaving together strands of history, feminism, and decolonial theory into a compelling tapestry of insights. At its core, the book scrutinizes the intertwined legacies of colonialism and patriarchy, exposing how these oppressive systems continue to shape our contemporary world.

Vergès argues persuasively for a decolonial feminism that rejects Western-centric approaches and embraces diversity and complexity. She navigates through historical moments and global contexts, from the Caribbean to Africa, underscoring the resilience and resistance of marginalised voices against colonial and gendered violence.

One of the book's standout contributions lies in its critique of the Eurocentric foundations of feminism, urging a more inclusive and intersectional approach. Vergès illuminates how traditional feminist movements have often sidelined the experiences of women of colour, indigenous women, and queer communities, thereby perpetuating exclusionary practices.

Central to Vergès' narrative is the notion of 'radical openness,' which encourages a reevaluation of knowledge production and power dynamics. By centring marginalised perspectives and challenging dominant narratives, she advocates for a transformative feminist praxis that acknowledges the complexities of identity and power.

Moreover, the author interrogates the complicity of Western institutions and policies in perpetuating colonial and patriarchal structures globally. Through rigorous analysis and incisive critique, she invites readers to reconsider their roles in upholding or dismantling systems of oppression.

🖼️ Exploring the canvas:

Orsola Maddalena Caccia's "Fruit and Flowers," painted in 1630, exemplifies Baroque still life with its meticulous attention to detail and rich, dynamic composition. This work showcases Caccia’s deft handling of chiaroscuro, the dramatic interplay of light and shadow, which lends a palpable three-dimensionality to the depicted objects.

The painting's composition adheres to a balanced yet asymmetrical arrangement, drawing the viewer’s eye across the canvas in a natural, flowing motion. The vivid hues of the fruits and flowers contrast beautifully against the darker background, highlighting Caccia’s mastery in colour theory and her ability to evoke texture and depth.

Each element in the painting—from the delicate petals of the flowers to the varied surfaces of the fruits—demonstrates Caccia’s keen observational skills and her ability to render the natural world with precision and sensitivity. The intricate detailing and the lush, almost tactile quality of the objects invite viewers to appreciate the transitory beauty of nature.

💭 Brainwaves and Whimsy.

Breathe.

“In the end, I would rather say I loved too much than not enough”

An ideal Sunday plan looks a lot like some time spent in nature with a beautiful walk and eating delicious food, either made at home or at a neighbourhood cafe.

I’ve been wondering how to dress without blending in with the trends saturating Instagram.

Thanks for being here. I'll see you next week with the newest issue of Brevity Margin!

Wishing you a productive week filled with moments of tranquility,

Abigail

A great read! As an Indo I think the strategic approach to military spending is interesting. Before the Ukraine war they had to cancel an order of 11 fighter jets from Russia but most of Indo's high-tech equipment comes from Korea. But it will be interesting to see the purposes of the spending, whether it be to protect South China Sea sovereignty, or to prepare a defense strategy against a potential attack from China to Taiwan.